Company FDs have emerged a good investment option in the recent years primarily due to their high interest rates but they also carry huge risks. Investors therefore must tread carefully and take an informed decision. In this blog article, we uncover the factors that must be considered before investing in a CFD.

How to Choose a Corporate FD? What are the factors that must be considered before investing in a CFD?

- One should not fall in the trap of deposit schemes that offer unreasonably high returns like 15%.

- One must also study the business viability of the company properly. Companies with balance sheet losses, those which do not pay dividends regularly must be strictly avoided. The repayment history of the company must also be studied. All these parameter help to determine the company’s credit score, credibility and stability.

- One should choose a company which has a good reputation. The company must have a reputation of maintaining good corporate governance standards, must have a good reputation in the media and among the stakeholders for providing good customer service. It is better to study various schemes of the company and choose a scheme that gives the best return. It is also better to opt for a cumulative scheme where the interest amount is reinvested and a lump-sum amount is obtained at the end.

- One should never choose unrated company deposit schemes and schemes of less known manufacturing companies as the default risk will be very high in these schemes. Although RBI has made it mandatory that only companies with ‘A’ rating can accept deposits, it is better to go in for companies with ‘AA’ and ‘AAA’ ratings. Though these deposits do not offer high interest rates they are relatively safe.

- One should go in for shorter tenures of around 1 -3 years. Usually deposits with longer tenures offer higher interest rates. But it is advisable to avoid deposits with high interest rates. This is because in the case of longer tenures CFDs any change in the company’s performance will negatively impact the deposit. Also when the deposit has a longer tenure the company may not pay the interest regularly.

- One can also diversify the risk by investing in more than 1 good scheme rather than putting all the money in one scheme. As a simple rule maximum exposure to a company must not exceed 10% of the total investible funds.

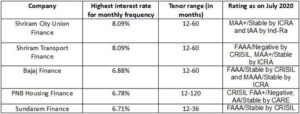

So, which are the top CFDs which give the highest returns to the depositors. The following table lists the CFDs that give good returns to the investors.

Compiled from Bank Bazaar

Need help availing an CFD? Contact us to get assistance on availing the right CFD with higher returns and less risk. Call us today on 8527853048 or drop a mail to info@fincomienzo.com

Recent Comments